Soon after I started blogging, Tyler Cowen joked, “You’re not really a blogger.” His point: Unlike most of the competition, I wasn’t reacting to the latest news or whatever’s hot. My goal as a blogger has always been to write think-pieces that stand the test of time.

https://www.econlib.org/a-fond-farewell-to-econlog/

I don’t know about standing the test of time where posts on EFE are concerned, but my approach to blogging is very similar: I prefer to not write about events immediately after they’ve occurred. This for a variety of reasons, not least of which is the fact that I’m lazy, and reading a lot of stuff at very short notice is something I would rather not do.

Another reason is that the very best pieces on any event usually take time to bubble up in my feed, and waiting therefore makes sense.

By the way, if you aren’t yet subscribed to Bryan Caplan’s new blog, please do!

But that being said, let’s talk about yesterday’s rate hike.

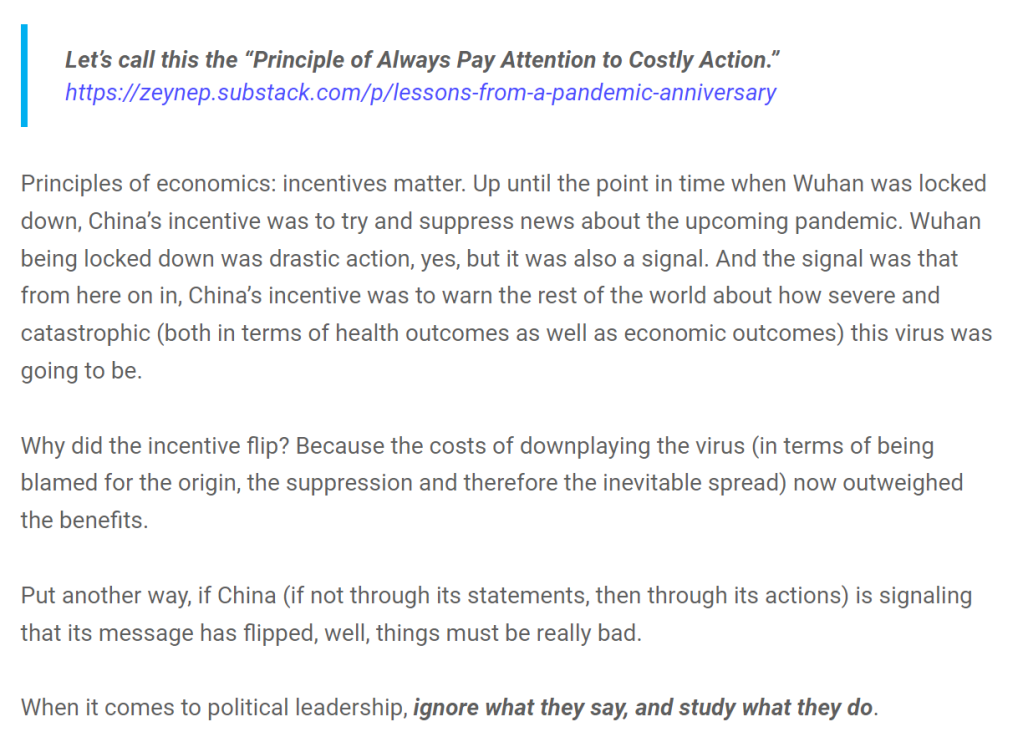

One of the pieces that I enjoyed writing last year was on the concept of meta-epistemology, after reading a post about it by Zeynep Tufekci.

I’m going to post a screenshot rather than an extract, because the formatting of the post helps:

Honest question: does this apply to the Reserve Bank of India as well?

Is it the case that the cost of downplaying inflation as a major problem now exceed the benefits of doing so? Have the incentives flipped for the RBI? If so, on what basis? Is there a sense, based on preliminary data, that inflation is a problem that can no longer be ignored?

And if so, how should we be interpreting not just the fact that rates have been raised, but the manner and the timing of the raise? In other words, are there two messages being sent out by the RBI: the message itself, and the implicit message encoded in the timing of the message?

And have (or will) the markets internalize this message, and if yes, what is to follow?

Learning about inflation, monetary policy, and the efficient market hypothesis via textbooks is less than half of the story. Take your view/model of how the world works to the world itself, and update your model as the years roll by.

Fun, exhilarating and occasionally nerve-wracking.

But it is the best way to learn.