I began teaching a course on introductory macro this past Saturday at a college here in Pune. I often tell my students that my job in a macro course is to leave them more confused at the end than they were at the start. That always evokes laugther by way of response, but as anyone who has learnt (and especially taught!) macro will tell you, I’m quite serious.

Macroeconomics is hard, it is confusing and as the person responsible for teaching it, you’re always on your toes, because you’re never sure if you’ve understood it yourself!

And I really do mean that, it is not a rhetorical statement. My own PhD is in macroeconomics (business cycles, more specifically), but I’ll happily admit to still not being sure about what exactly causes business cycles, what (if anything) to do about them and when to stop doing whatever it is that we’ve chosen to do about them. And I suspect that most macroeconomists will tell you the same thing.

This humility stems from a very good reason: macro is hard.

It is hard for lots of reasons, and not to get too meta, but quite a few debates within the field are also about which of these reasons are most relevant, and whether the relevance changes over time – and if so, due to which reasons!

But if I were to try and write a simple post for people who have no formal trianing in macro about why macro is so hard, here would be my reasons:

- Macro is really about trying to figure out everything that goes on in an economy, and if you try to think about all the things that go on in an economy, you very quickly realize that figuring them out is even more challenging.

- Time and uncertainty!

- Macroeconomic decisions take time. It takes time to decide to start a new factory. It takes time to figure out the financing. Land acquisitions, regulatory approvals, construction delays will all add weeks to the planned schedule, if not months, and sometimes years.

- These expensive decisions are made at the start, but there is no guarantee that macroeconomic conditions will be the same at the finish of the project as they were at the start. You want a relatable example? How sure are you that macroeconomic conditions will be the same when you graduate from college – as they were when you enrolled in it?

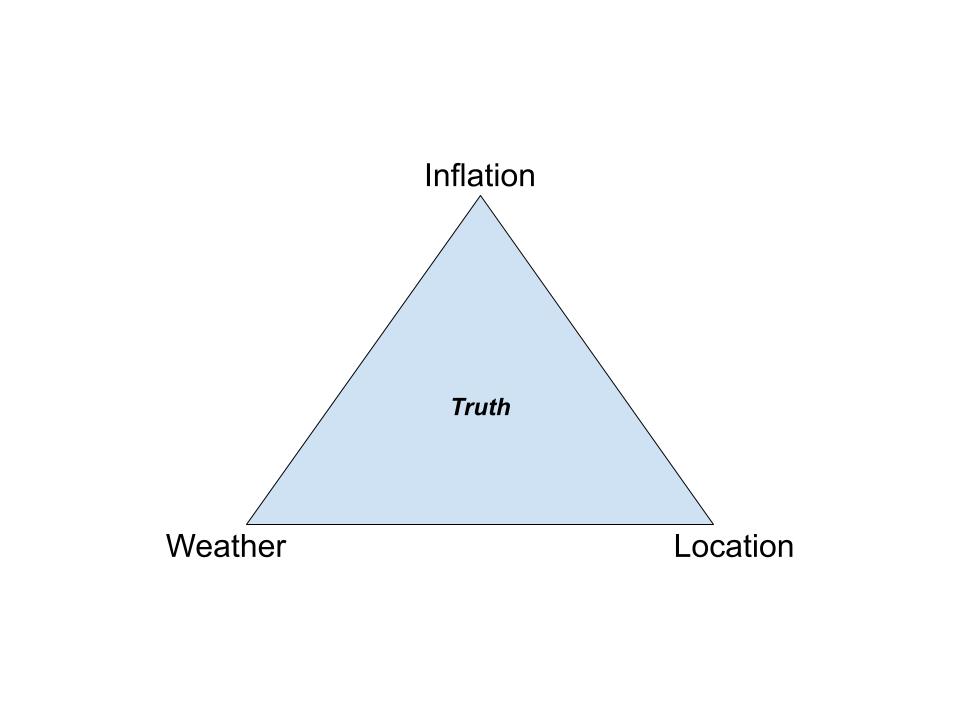

- The way macroeconomic variables interact with each other isn’t known for sure. We think we know how inflation and unemployment are related to each other, but we can’t really say for sure. We think we know how exchange rates impact the domestic economy, but we can’t really say for sure.We’re still figuring out how monetary policy and fiscal policy should interact in theoretical models, let alone in reality. The impact of monetary policy in America today on India’s economy tomorrow? Don’t get me started. I can go on, and folks with greater expertise than me will prbably not stop for years.

- Life has a way of throwing up surprises that macroeconomic models never thought about. You could (and probably should) blame macroeconomists for not getting enough finance into their models prior to 2008, but who, pray, could have foreseen 2020 and 2021? How do you come up with models and policies on the fly in such a scenario? And then, just for fun, throw in a jammed Suez canal. Life, I tell you.

We call these things exogenous shocks in macroeconomics, but the name hardly matters. Reality will always be more complex and more unexpected than any model you can come up with, and that’s just a fact. - Counterfactuals are impossible to test. How do we know that Ben Bernanke did the “right” thing in 2008? We don’t! What if he had done x instead of y? There’s no way to test this, since we can’t turn the clock back to 2008, and ask Mr. Bernanke to, well, do x instead of y. This is both a problem and when it comes to critiquing models, a great convenience.

- Attitudes towards risk, and the propensity to copy what others are doing change according to your outlook towards the macroeconomic environment. You can call this animal spirits, but what you’re really saying is that you don’t quite know how to think about it, even less model it cohesively.

- Building a model – any model – requires simplification. When you build a model, it will by definition be an approximation. Unfortunately (and I wish this weren’t so), this very real limitation isn’t always front and centre within the field while developing models.

- What are you optimizing for when you build a model? Is it fidelity to reality or is it a beautiful model that may or may not have anything to do with reality? Again, I wish this weren’t so, but the answer isn’t always clear cut.

- Any field that uses the pool player analogy is a field that is, by definition, unsure about how the world works.

- No matter how much data we have access to, there will always be data points that we cannot capture, and we don’t quite know how these data points, and their unavailability, will impact our understanding of the economy.

- Social structures, psychological make-up, cultural parameters will all have an impact upon the decision making capabilities of individuals, but quite how this works (and that too across space and time) isn’t well known. For example, how would your grandfather have reacted to the prospect of not being employed upon graduation? What about your dad? What about you? What does this say about the nature of India’s changing economy, and what does it say about cultural norms and expectations? Is your answer likely to be different depending upon how much your family earns, where in the country you are located and your family size? Can we model this? (Hint: no.)

So sure, I’ll teach them about the variables, the models and the case studies.

But I’ll let you in on a dirty little secret, so long as you promise not to tell anybody: I’m just not sure if I really and truly understand what I’m teaching in macro.