Explain, Samrudha says, the difference between perfect competition and monopoly to a five year old. Not, mind you, an ELI5. To a five year old.

And not just any old explanation, he goes on to add. Explain it as a joke. Again, to a five year old.

And having decided that this is not enough (Samrudha takes his local non-satiation very seriously), this has to be done within the length of a tweet.

So: explain the difference between two economic concepts to a five year old, in humorous fashion, and within the length of a tweet.

This is what those general purpose transformers were invented for, no? Summon forth a knight of the large language realm, and command it to oblige us!

And verily it was summoned, and verily it laid an egg:

So can we leave CRISPR editors, protein folding and spreadsheets-on-steroids to those knights of the l.l.r, and have them leave Samrudha’s trilemmas for us?

I volunteer to step up for team human, if volunteer is the word I’m looking for:

Here are the rules of engagement:

- I will not ask Claude/ChatGPT/Gemini to help me draft my tweet length microecon theory joke for a five year old.

- I can refer to Google/textbooks if I wish to for academic references, and to source and modify jokes (but this is optional, not mandatory)

- My explanation cannot be more than 280 characters in length (and thank god the world has doubled in quality since Peter registered his complaint)

- The tweet should be accurate from the point of view of theory and it should elicit a response that lies somewhere on the Groan-Chuckle-LaughUproariously scale.

- I can ask C/C/G to evaluate my work of art

If you wish to step up and do battle, please be my guest. But these rules listed here are sacrosanct, mind you!

With that being said, here’s my thought process:

- I want to emphasize (to the five year old) the fact that there are “goods” out there that are very similar to each other in terms of quality, and that they “cost” the same.

- One ought to be indifferent about who one “buys” this good from among the many sellers offering it.

- So in effect, many sellers | same price | homogenous good are the three features of perfect competition I am choosing to focus on.

- I also want to emphasize that the five year old can choose to “spend” their “endowment” somewhere else too.

- This somewhere else must be a good that is different in the eyes of the five-year old, in terms of quality. It must be available from a single seller, and at a higher price than the perfectly competitive “goods”.

- And of course, this point must be made as a joke that is comprehensible to a five year old, and both the point and the humor must be appreciated.

- And, of course, in 280 characters.

Why are “goods”, “cost”, “buys”, “spend” and “endowment” in inverted quotes? Because these concepts (and others too – price, for example) matter, but must be used/explained in such a way that a five year old “gets” them.

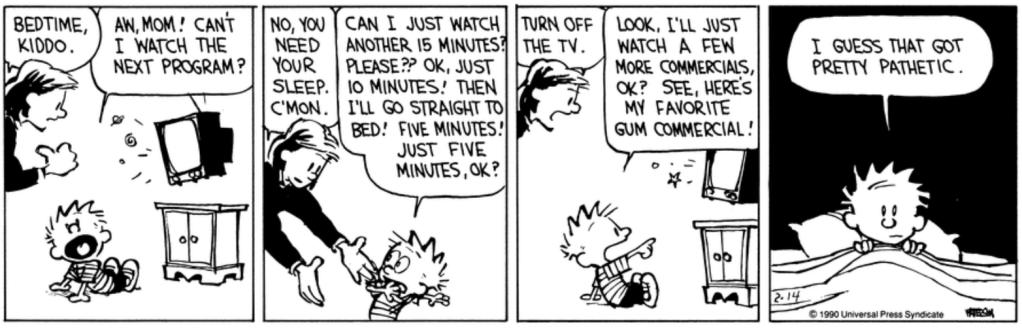

Since money is a difficult concept to explain to a five year old, what is scarce in a five year old’s life? I’m a parent to a ten year old, and I can confirm that some things haven’t changed since the 1990’s:

So let’s say the five year old has fifteen minutes to “spend” before bedtime, and she can “buy” whatever video she wants to watch. Whatever she watches by definition implies that she can watch nothing else, and let’s assume that only whole units can be consumed – she can’t start to watch a video and discard it as boring twenty seconds into it.

(Not a realistic assumption? You don’t say. But cut me some slack here, dammit!)

So should she watch three random ChuChu TV videos, or a Peppa Pig episode?

What, you ask, is ChuChu TV? And, you ask, what is Peppa Pig?

Jon Snow knows more than you do.

There’s no end to ChuChu TV videos (trust me, I know), and there’s no end to clones of ChuChu TV videos (again, trust me). They all look the same, sound the same, and for all I know and care, are the same.

And while you’d be right to say that there’s no end to Peppa Pig videos either, there’s no clones of Peppa Pig videos. I mean, folks may have attempted cheap knock-offs, but as with the iPhone so with Peppa Pig. If you don’t have it, well, you don’t have it (and yes, once again, trust me. I know).

And so here’s my tweet length joke, understandable where a five year old is concerned, that explains the difference between perfect competition and monopoly:

You have only fifteen minutes until you go to bed. Do you want to watch three ChuChu TV videos, or one Peppa Pig episode?

Not bad, you might say. But how’s this funny?

As I was saying, Mr. Not-Even-Snow.

Every single parent (and kid) reading that bit got it.

You have only fifteen minutes, it seems.

Hahahahahahaha.