Here are links to the official sources:

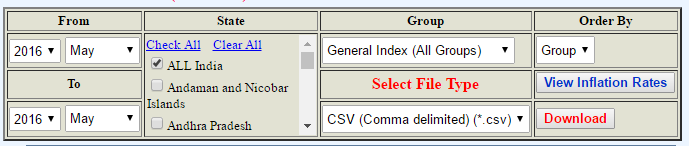

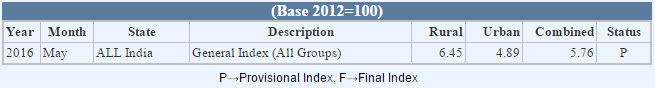

The latest CPI report on the MOSPI website.

The WPI PDF report from the EA Industry website.

If you want a secondary source with better graphs, Trading Economics is a good option.

But that’s not what I want to talk about today. What I want to talk about is how you might think about inflation.

Greg Ip, the chief economics commentator for the Wall Street Journal, speaks about how he came to deeply understand the topic of inflation when his mother told him that his pocket money would be linked to the consumer price index in Canada, which is where he grew up.

It’s one thing to ask students in a class to visit a website that provides information about inflation, and it is quite another to have a young person’s pocket money be linked to it. Guess who is more likely to follow the website keenly, and guess who is likely to ask questions along the lines of “But why should the prices of zarda, kimam and surti impact my pocket money, huh?”

(Item code 2.1.01.3.1.07.0 and these together carry a weightage of 0.04869% in our CPI. Link here, and while you are at it, look up 6.1.04.1.1.03.0, and 6.1.04.2.2.01.0, and ask yourself some very interesting questions. There’s lots more to ponder about in that PDF, these are just to get you started!)

But there’s other things to ponder about where inflation is concerned too:

If it really wanted to get ahead of the inflation challenge, India’s central bank should have paid more attention to Surf Excel.

https://theprint.in/opinion/magic-prices-did-warn-of-indias-sticky-inflation-but-rbi-didnt-notice/957873/

The price of the laundry detergent went up by 20% in January. While that’s hardly news when most everyday things are becoming dearer everywhere, the interesting part was the retail price before the change: Rs 10 (13 US cents) for a bar.

Such tiny bars of detergent are targeted at less affluent consumers who are often unable to spend a rupee more without having to cut back on something else. To prevent these customers from downgrading to cheaper products, Unilever Plc’s India franchise relies on “magic price points” — such as Rs 5 or Rs 10 — that help buyers stay within their tight budgets.

Read the rest of the article, and if you are unfamiliar with pricing, especially in an Indian context, this will help you learn about the nuances of inflation. You may or may not agree with the article’s conclusions about spotting inflation in India, and that’s fine, as far as we’re concerned. But what we should be learning is an important lesson:

Inflation is about more than just changing prices.

And finally, give a listen to this podcast – and if you can’t be bothered to listen to the whole thing, the really interesting bit starts at around the 24th minute or so, where Tyler Cowen and James Altucher help you understand how you might build your own inflation index. We got a puppy home recently, and I can attest to some of the points made in that section!

Read the news and make sure you keep an eye on inflation, sure. But learn – especially when it comes to a topic like inflation – that textbooks and newspaper articles are only a start. These topics are way more complicated than that.