The Story So Far

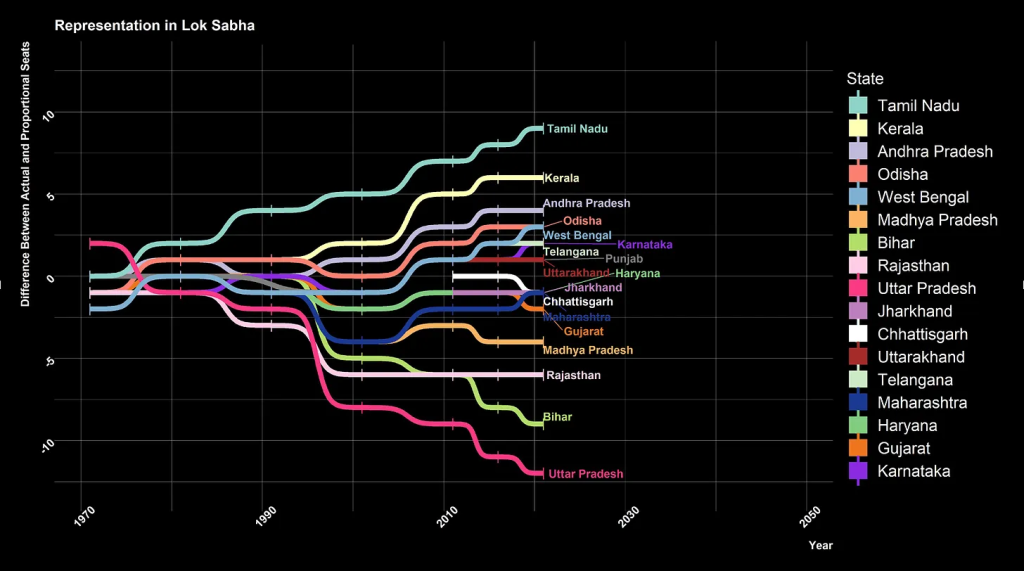

Today’s post is a continuation of yesterday’s. We learnt in yesterday’s post about the problems with the upcoming delimitation exercise, and how the Southern States feel that they contribute “too much” to Union government taxes, and get “too little” in return. The reason the phrases in the previous sentence are in quotation marks is because there are major differences of opinion about whether this is the case or not.

Asking a politician about this question is a useless endeavor, at least in public, because they’re optimizing for answering the question in a way that maximizes their current electoral benefits. If it is more important (for the moment) to win state elections, they will say that it is true that states doth give too much. If it is more important (for the moment) to win national elections, they will say it is true that the Union government doth take too little. This is not a criticism of politicians, please note. It is an application of one of the simplest principles in economics: incentives matter.

And by the way, for those of you thinking I’m throwing shade at a particular political party, perish the thought. All politicians in all countries have done this in the past, regardless of their ideology, they’re doing it now, and they’ll do it in the future. You and I would do it too, in their place, for those have become the rules of that game. So it goes.

Well, can us economists do a better job? How do economists think of the answer to the question of how much is the “correct” amount to be transferred from a given state to the Union government? How do economists think of the answer to the next obvious question – how to think through vertical and horizontal devolution?

In today’s blogpost, I am going to try and answer this question, but in terms of frameworks, not in terms of data. My job today is to help you develop a framework about thinking through this issue. Once you have a framework, the data tends to make much more sense – or so some economists hope. I’m one of them.

Let’s begin!

Trade is a non-zero sum game

You’ve heard me say this before, and you’ll hear me say it again. Today is a good day to reiterate this point – it is as important as the point “incentives matter”:

Trade is a non-zero sum game

People just don’t get this point. When two parties engage in trade voluntarily, both parties are better off. When I pay the chai-tapri owner ten rupees for a cutting chai, he’s grateful for the ten rupees I give him, and the lord knows I’m grateful for the chai I get in return. This is equally true for an overpriced cup of Americano at Starbucks. Sure it’s over-priced, over-roasted and over the top, but you know what you don’t see outside Starbucks? You don’t see Starbucks baristas kidnapping people and then forcing them to buy coffee (venti, naturally). It is voluntary trade, and the reason folks step in to a Starbucks is because they want to buy that coffee. The trade is worth it to them.

And that simple idea underpins modern economics. Why, you might say it defines who we are as a species!

So I would urge you to think of the “problem” of the Southern states as a trade between the states and the Union government. We’ve heard from the Southern states side of this debate – they think they give too much to the Union. Well, if this is a trade, it is worth asking the obvious question.

What do the Southern states get in return?

There are two questions at play here, not just one. And it is important to think through both of these questions:

- What do the Southern states get in return from the Union government?

- What do the Southern states get in return by being a part of a Union?

Think back to the young man who plaintively called up his uncle from yesterday’s post. Everybody in that young man’s house contributes half their salary to run the house, and our young friend feels hard done by, because he earns the most (and therefore contributes the most). Worse, once the money is pooled in, he doesn’t get a bigger say in how it is to be spent – that decision is purely democratic. So he feels he pays in too much, doesn’t get enough in return, and doesn’t have enough of a say in how the money is spent.

But as an economist, I would urge him to be more holistic in his thinking. Young man, I might harrumph in his direction, should you not be accounting for the pleasure of having your friends stay with you? The emotional benefits? The security you get by staying together? The ability to call on the help of near and dear ones when the time arises? You may still feel hard done by, and maybe you should, that’s not for me to say – but I would urge you to do a complete cost benefit analysis.

The Cost Benefit Analysis Framework

Weird tangent alert – you’re going to feel I’ve flown off the handle here for a bit, but I’ll circle the discussion back to the topic at hand, I promise. But for now, let’s talk migration. Say you are an unemployed youth in a rural part of our country, with not much education. Should you migrate to the city in search of a job?

Here’s a framework to help you think through the answer to this question:

It looks like a pretty complicated picture the first time you take a glance at it, but all that it is really saying is this:

- How much will you earn by living in the city?

- How much do you earn now?

- How much will it cost to be in the city?

- How much does it cost to stay where you are?

- Not just economic costs and benefits, mind you! Note the boxes that talk about psychic costs and psychic returns!

Net all of this out, and if you’re in the black, move to the city. If you’re in the red, stay where you are. Easy-peasy.

It never is that easy, of course, and cost-benefit lists aren’t always the answer. But us economists will always give poor ol’ Ross a sympathetic pat on the shoulder. He was wrong, of course, but still. Brownie points for using a framework (and god help you).

What framework can we use?

So, OK, here is where we are now:

- Think of the delimitation and devolution exercise as a trade between the states and the Union government.

- The Southern states are quite clear about the fact that they think they’re contributing too much.

- But they should also think about what they’re getting in return from the Union government, and by being a part of the Union.

- A cost-benefit analysis will help, as will a cost-benefit framework.

So let’s go find a framework!

And what framework am I going to use? I’m going to call upon the ideas of the great Canadian economist, Robert Mundell (and those of Peter Kenen). A very accessible discussion of these ideas is to be found in a lovely little essay by Paul Krugman, called Revenge of the Optimum Currency Area. The title is a play on important work done by Robert Mundell in the late 1950’s on the topic of Optimum Currency Areas (OCA’s).

What are OCA’s? Have you ever wondered why, say, all SAARC nations don’t have the same currency? If you are going to break out in spots and rashes at the thought of having anything at all to do with Pakistan, calm down, and think of why all the ASEAN nations don’t have a single currency. And then think of how and why all of the states in the United States of America chose to have a common currency.

What are the conditions, Robert Mundell was asking, under which having a common currency across different political jurisdictions is optimal. And (very) long story short, Paul Krugman’s take on the issue, courtesy Mundell and Kenen’s ideas, is this:

It makes sense to have the same currency (a monetary union) across political jurisdictions if:

- These jurisdictions have labor mobility

- These jurisdictions have capital mobility

- These jurisdictions have a fiscal union

What if we “flip” this around? For those of you familiar with linear programming, think of the “dual”. It is not an exact analogy, I’ll be the first to admit, but try this on for size:

It makes sense to bear the costs of being in a fiscal union across political jurisdictions if:

- These jurisdictions have labor mobility that proves to be beneficial

- These jurisdictions have capital mobility that proves to be beneficial

- These jurisdictions have a monetary union that proves to be beneficial

That is, so long as the net benefits that accrue from having labor mobility, capital mobility and being in a monetary union are more than the net costs of being in a fiscal union, it is more than worth it.

(This is worth emphasizing again: net benefits and costs. Sure there are costs to being in a fiscal union, but there are benefits too!)

Labor mobility means being able to count upon (freely!) accessing surplus labor from other parts of the country. Capital mobility means ditto, but for capital, not labor. And a monetary union is, of course, having the same currency across all states. What is the net benefit from all of these? So long as this is more than whatever the (actual and perceived) costs of being in a fiscal union are, well, all izz well.

But kahaani abhi baaki hai mere dost!

Heresy for an economist, but counting is problematic

My head hurts just thinking of the number of academic papers that can be churned out in terms of trying to quantify the previous section. We can keep the paper mills churning for years on end, and LinkedIn will drown in a deluge of “Delighted to share that our paper on…” messages.

But I would say that such exercises will ultimately be futile. Why, you ask? Here’s Paul Krugman’s take on this:

Now, what we need to say right away is that this “weighing” takes place only in a qualitative sense: at this point nobody says that the benefits of joining the euro are x percent of GDP, the costs y, and x > y, so the euro it is. Instead, it is more along the lines of arguing that Florida is a better candidate for membership in the dollar zone than Spain is a candidate for membership in the euro zone. This does not necessarily say that Spain made a mistake by joining the euro—nor does it necessarily refute the argument that Florida would be better off with its own currency! But the theory does at least give us some insight into the trade-offs.

https://www.journals.uchicago.edu/doi/full/10.1086/669188#

And my own take is this: remember psychic costs and benefits from our migration example? Drill this into your head – just because these cannot meaningfully be measured doesn’t mean they don’t exist!

What are the psychic benefits of being in a monetary and a fiscal union? In English, if you prefer (and you should, because economics is a most unpoetic* language):

What are the psychic benefits of being part of a nation?

Equally, because being analytical requires being evenhanded, what are the psychic costs of being part of a nation? Factoring in the answers to these questions is impossible very, very difficult. So very impossible difficult, in fact, that I would be of the opinion that it cannot and should not be done.

So how to think of a solution?

Ronald, the OG, will tell us all about it on the morrow.

*It’s a word, and I will not be taking any questions.